Understanding Unpaid Taxes in NJ Property Transactions

Buying, selling, and owning homes comes with various costs, including purchase prices, fees, commissions, maintenance, and taxes. Most people do not realize the extent of the taxes they must pay for real estate, sometimes until it is too late. You can suffer significant financial losses, face legal challenges, and lose your home for unpaid property, transfer, capital gains, and other taxes. You can also lose money in a real estate deal without properly addressing unpaid taxes from a legal perspective. For this reason, it is extremely important to understand your own and the other party’s rights and responsibilities when it comes to unpaid taxes on a property, strategies for addressing these challenges, and why having a solid real estate lawyer on your side every step of the way is essential before signing on the dotted line.

Buying, selling, and owning homes comes with various costs, including purchase prices, fees, commissions, maintenance, and taxes. Most people do not realize the extent of the taxes they must pay for real estate, sometimes until it is too late. You can suffer significant financial losses, face legal challenges, and lose your home for unpaid property, transfer, capital gains, and other taxes. You can also lose money in a real estate deal without properly addressing unpaid taxes from a legal perspective. For this reason, it is extremely important to understand your own and the other party’s rights and responsibilities when it comes to unpaid taxes on a property, strategies for addressing these challenges, and why having a solid real estate lawyer on your side every step of the way is essential before signing on the dotted line.

Guide to Property-Related Tax Obligations in New Jersey Real Estate

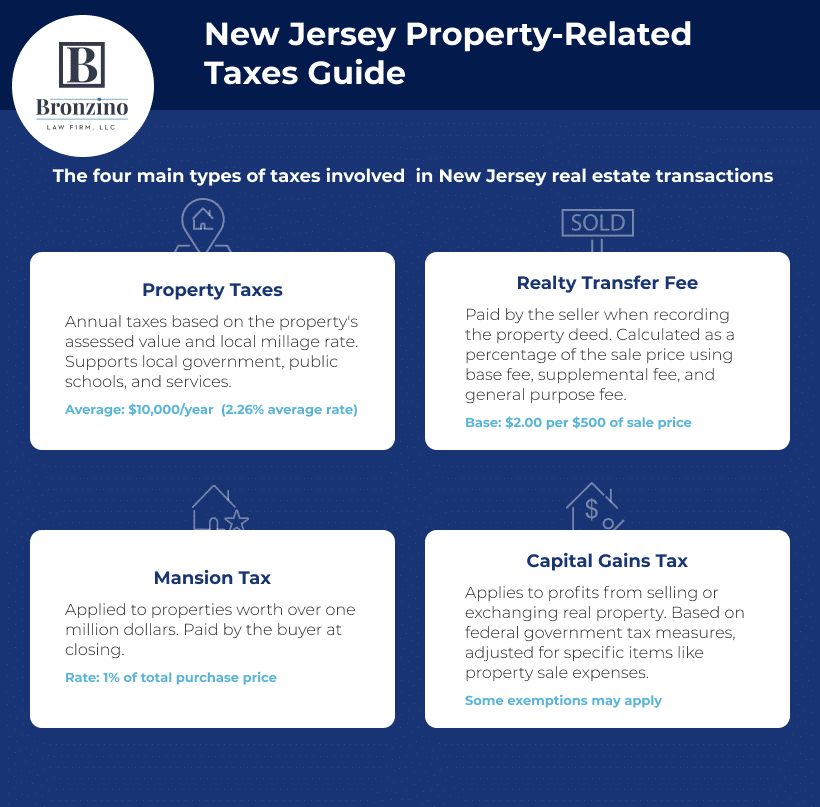

New Jersey requires sellers and buyers to pay several taxes in real estate transactions, which can add up. The most well-known tax on real estate is primarily based on the value of the property. Property taxes in New Jersey average close to $10,000.00 a year based on a 2.26% average property tax rate. However, the assessed home value is the basis for the tax. These can be much higher depending on the home value and the specific area.

Property Tax Bill

To calculate property taxes, the local tax assessor first places a value on your property, which may not be the fair market value. The assessed value and local tax rate, or millage rate, form the basis of property taxes. Municipal and school boards set the millage rate annually. Multiplying the assessed value by the millage rate gives you the annual property taxes you pay.

Property taxes support local government, public schools, and local services, such as fire and police. Property tax bills account for a property’s assessed value, the costs of running government and public schools, the total value of all taxable and tax-exempt properties, and any other available revenue for each municipality. The total equation divided among taxable properties forms the basis of each property’s taxes. Other factors may increase taxes, such as inflation. New Jerseyans receive their property tax bill annually around mid-July, payable in quarterly installments on the first of February, May, August, and November.

Fee to Transfer the Property

Another property fee is the state of New Jersey’s realty transfer fee, calculated as a percentage of the real estate sale price. The seller pays this fee when they or their agent records the property deed. The realty transfer fee goes up with the real estate purchase price. The state uses a formula based on three components, a base fee, supplemental fee, and general purpose fee. All transactions start with a base fee of about $2.00 per $500.00 of the sale price. From there, supplemental fees of $1.75 per $500.00 kick in. The general purpose fee taxes property sold for a million or more and adds $1.25 per $500.00 on top of the base and supplemental fees.

Buyers’ Responsibilities for Mansions

Yet another tax is the Mansion Tax on properties worth more than one million dollars. The buyer pays a 1% tax on the property’s total purchase price, whether it is a home or commercial property. The fee is due at the sale transaction’s closing.

Taxes on the Profit from the Sale

Capital gains taxes on the profits from selling or exchanging real property are another tax some people must pay. The tax is based on what you gained from a property sale or exchange, so the gain is measured on the basis the federal government uses to tax individuals, adjusted for specific items, like property sale expenses. Some people are exempt from capital gains taxes, and some do not profit from a property sale.

Navigating Tax Responsibilities in Your NJ Real Estate Transaction

Besides the seller’s responsibility for transfer taxes and the buyer’s responsibility for mansion taxes, the legal owner of the property at the time of the sale closing is responsible for paying property taxes. So, when the sale closes after the seller pays quarterly taxes, the buyer is responsible afterward. However, a buyer may be responsible for reimbursing the seller for property taxes paid proportional to the time the seller owned the home before the sale closing.

The seller is responsible for clearing up any tax liens on the property before the sale closes. A title company and escrow company typically play roles in the real estate transaction. Title companies search the property for outstanding liens and verify a good title. Escrow companies hold funds contributed by the buyer and seller for the various fees each is responsible for during the purchase transaction, including taxes. That way, the parties can be assured the necessary taxes are paid. The escrow is a fiduciary to the parties to ensure payments and document transfers.

The buyer is ultimately the one who is penalized when taxes are unpaid because the local government can place a lien on the property. The lien stays on the property until the taxes are paid or the municipality or tax certificate holder auctions off the title to the buyer’s property. When the seller does not pay the transfer fees, the escrow may not close, and they could lose the fees they paid into escrow. Ultimately, the lien for transfer fees is attached to the property. The buyer could sue the seller for nonpayment of the taxes, a breach of the real estate contract.

How to Uncover and Resolve Property Tax Issues in Real Estate Transactions

Using a title company to do a thorough search can alert you to problems with the title and reveal tax liens for unpaid taxes. Buyers or their agents typically run title searches when the seller accepts their purchase offer to ensure the property is transferable. However, a title search may not turn up all tax liens for unpaid taxes because of the various tax due dates. If you are the buyer, you may not know the seller did not pay taxes because the due date has just passed, and a lien is not yet attached to the property.

Property owners who fail to pay property taxes could lose their property. New Jersey municipalities hold annual tax sales to recoup delinquent taxes through tax sale certificate auctions. A tax certificate is a lien on the real property that earns interest at the rate established by the winning auction bid. The auction winner pays the municipality the outstanding taxes in exchange for the tax certificate, which is typically recorded. The tax certificate holder can foreclose on the property after two years unless the buyer pays off the lien amount with penalties. Unpaid taxes can have severe consequences, so a buyer must ensure taxes are paid before closing a real property sale. When a dispute arises or the seller cannot pay the taxes, the buyer might negotiate a compromise or alternative solution. For example, the buyer can pay the taxes and contract with the seller to repay them or take a purchase price reduction equal to the taxes.

Other solutions may resolve the tax problem, but you may not know your options. For this reason, you want the help of a real estate lawyer. Attorneys who negotiate property purchases have a history of negotiating tax debt for the benefit of buyers and sellers. Depending on the circumstances, they have a store of creative solutions to save a sale. Their knowledge of the law allows them to advise you on the legal options for getting around impasses on tax issues.

The Broader Impact of Property Tax Default on Real Estate Deals

A lawyer is invaluable at anticipating potential legal disputes and preventing them from happening when possible. For example, a title search or inquiry with the local tax collector may show a tax lien. A tax lien on real property stays there until the lien is paid or the lienholder forecloses or sells the lien to someone else. The lien is in the amount of the taxes owed to the municipal, state, or federal governments. An attorney may advise you to research the property.

A lawyer can also help a property owner save their property when foreclosure is imminent or has begun by the municipality or the tax certificate holder. Foreclosure is a legal proceeding in which a lienholder takes the real property that is collateral for the debt. It can occur after two years of an investor’s or individual’s purchasing a tax certificate or six months for a municipality. Foreclosure can also occur by filing a foreclosure lawsuit. Falling behind on taxes can lead to a lien and loss of your home, but not necessarily to a poor credit score. Credit rating agencies do not lower your credit rating for an existing tax lien. However, you may be unable to borrow against your property, and a foreclosure will negatively affect your creditworthiness for at least seven years.

Whether you are trying to save your property from foreclosure, redeem your home’s property value over a tax lien, or negotiate with a seller or buyer about unpaid taxes, legal disputes can be long and expensive. A real estate attorney can help you prevent future legal battles or help you out of one.

Prevent Legal Complications from Unpaid Property Taxes if You are Buying or Selling in NJ

An Experienced New Jersey Real Estate Attorney Can Safeguard Your Property Transaction by Addressing and Resolving Tax Issues

Whether you are the buyer or seller, seek the help of a knowledgeable real estate attorney at Bronzino Law Firm to review all documents related to the real estate transaction, advise you on how to handle unpaid taxes from a legal standpoint, negotiate a resolution, and guide you through attorney review and closing proceedings. Our team has spent over a decade helping people throughout Sea Girt, Point Pleasant, Asbury Park, Lakewood, Red Bank, Middletown, Ocean Township, Brick, Manalapan, Bay Head, and Seaside Heights, and Ocean and Monmouth County, with the legalities of purchasing and selling their properties. Contact us today for a free consultation by filling out our online form or calling our offices at (732) 812-3102 to learn more.