-

The Reality of Divorce Early 20s: Legal Rights and Financial Challenges

| 17-Jun-2025Categories: DivorceWhy Is Divorce in the Early 20s So Challenging? Everything You Should Know Getting married in your twenties may seem romantic and exciting. You have dreams of traveling together, maybe moving to another city to start fresh as your...

Continue Reading -

Key Considerations for Divorcing Couples in the Public Eye in New Jersey

| 09-Jan-2025Categories: DivorceBreaking Up in the Public Eye: Strategies for a Smooth Divorce in NJ Celebs of all genres, political figures, and well-known business world leaders feel the hurt we all feel when trying to get from start to finish in...

Continue Reading -

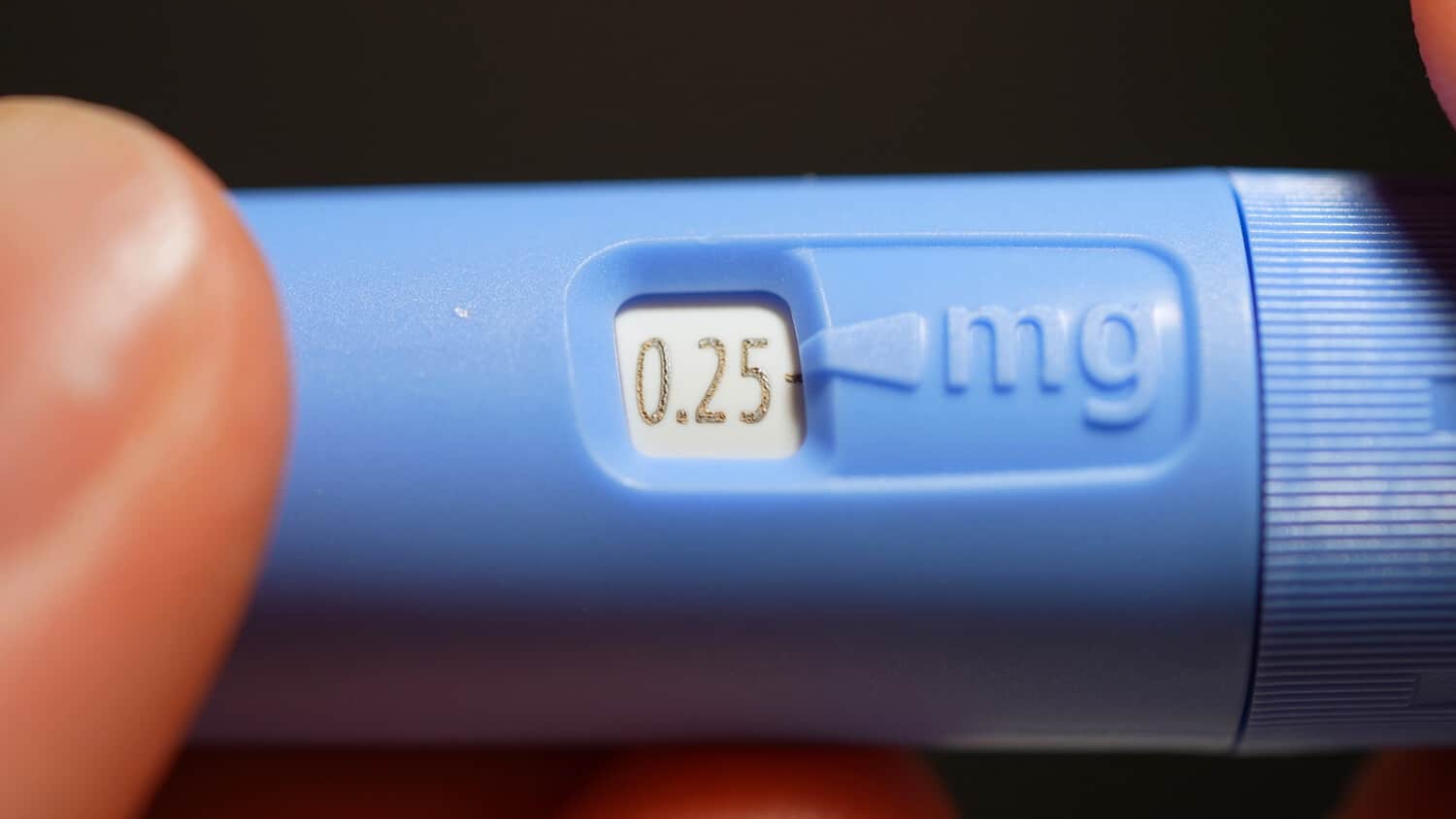

Ozempic, Marriage & Divorce from a Legal Perspective

| 05-Jan-2025Categories: Divorce, Family LawWhen Weight Loss Medications Transform Marriage Dynamics Unforeseen Marital Implications of Weight Loss Drugs and the New Role Ozempic can Play in New Jersey Family Law Cases Science seems to have encountered the magic bullet for weight loss. Ozempic,...

Continue Reading -

Addressing the Difficulties of Divorce for Dual Citizens

| 31-Dec-2024Categories: DivorceNavigating Divorce with Dual Citizenship: Legal Complications and Considerations in New Jersey Dual citizenship offers many benefits, from employment options to real estate purchases; many transactions in other countries are more manageable for citizens. Unfortunately, divorce is not one...

Continue Reading -

Implications of Deepfakes in NJ Family Courts

| 24-Dec-2024Categories: Child Custody, Child Support, Divorce, Family LawInfluence of Manipulated Digital Evidence in Family Court Decisions Is it Authentic? Deepfake Evidence Poses New Questions and Challenges in New Jersey Family Law Cases Deepfakes are launching new and unsettling hurdles right into the New Jersey family courts....

Continue Reading -

Why Divorcing Couples Frequently Opt for Pre-Filing Settlements

| 29-Nov-2024Categories: Alimony, Child Custody, Child Visitation, Divorce, Equitable Distribution, Family LawMotivations for Divorcing Spouses to Reach Agreement Before they File in NJ Whether you are familiar with divorce proceedings or not, they often involve a lengthy process in the court system. A divorce is final when a judge signs...

Continue Reading -

Understanding In-Law Conflicts in Divorce Situations & Methods for Successful Management

| 26-Nov-2024Categories: Divorce, Family LawHow to Keep the Peace and Maintain Successful In-Law Relations During NJ Divorce and Beyond Although divorce rates have diminished slightly in the past few years, about 44% of first-time married couples in the U.S. get divorced. The causes...

Continue Reading -

The Complex Web of Prenups, Wills, Divorce, and Death: What Takes Supremacy?

| 14-Nov-2024Categories: Divorce, Estate Planning, Family Law, Prenuptial AgreementsExploring the Legal Links Between Wills, Prenups, Divorces, and Deaths in New Jersey Marriage, divorce, and death – three important topics. What connects them all? The legal confusion that most people feel around them. Prenuptial agreements, wills, estate plans,...

Continue Reading -

Political Differences as a Precursor to Divorce in New Jersey

| 18-Oct-2024Categories: DivorceAn Insightful Look at How Political Disagreements are Affecting Marital Relationships and Dissolutions in NJ Today’s political climate has Americans more divided than ever. An increase in political activity and a decrease in political moderates has set the stage...

Continue Reading -

Remodeling Projects May Strain Relationships, Finances and Even End Your Marriage

| 14-Oct-2024Categories: Divorce, Family LawHome Renovations: Can it Push Couples to Divorce in NJ? You wouldn’t think that something as simple as renovating your house would end your marriage. However, conflict over colors, furnishings, and design styles can lead you to question your...

Continue Reading